charitable gift annuity tax deduction

Citizen or resident Sec. 2522 allows an unlimited gift tax deduction for a gratuitous transfer of money or property to or for the use of certain charitable.

Planned Giving Charitable Annuities Trusts Princeton Theological Seminary

Or estates or trusts including a deduction for estate or gift tax purposes cannot have a total value of more than 60 of the total FMV of all amounts in the trust.

. Terminable Interest Marital Deduction as Reported for Federal Gift Tax Purposes The decedent is bound by the election made for federal gift tax purposes. It must truly be a gift or donation that is you are voluntarily transferring money or property without receiving or expecting to receive any material benefit or advantage in return. 10 1988 the amendments made by this section amending this section and section 2523 of this title shall not apply to the extent such amendments would be inconsistent with the treatment of the annuity on such return unless the executor or.

To make such a gift do not sell the stock and donate the proceeds as this will jeopardize your tax benefits. It might be subject to the federal gift tax but you wont have to pay that tax. In the case of any estate or gift tax return filed before the date of the enactment of this Act Nov.

This article addresses various issues that may arise in the preparation of federal gift tax returns with a focus on gift tax returns that will be filed to report gifts made during 2009 or 2010. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Citizen is the only.

Charitable Remainder Annuity Trust. The tax deduction you receive for donations to charities is based on the fair market values of the items donated. The results will provide an overview of benefits including payout details deduction information and inputs.

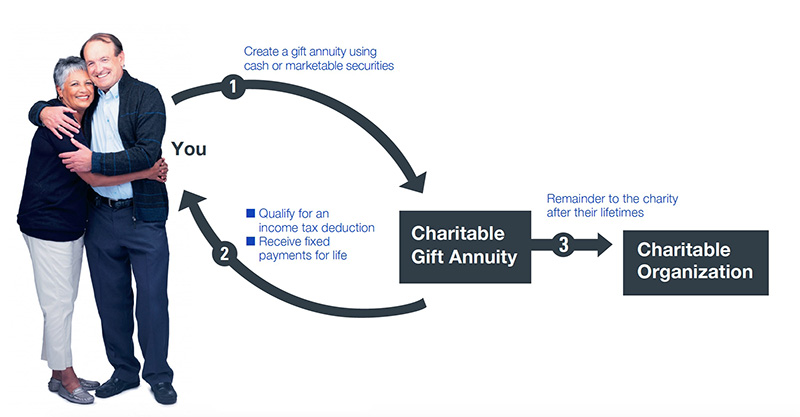

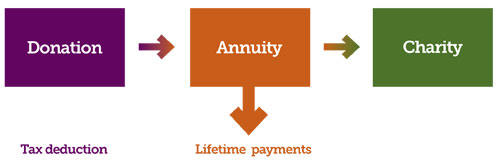

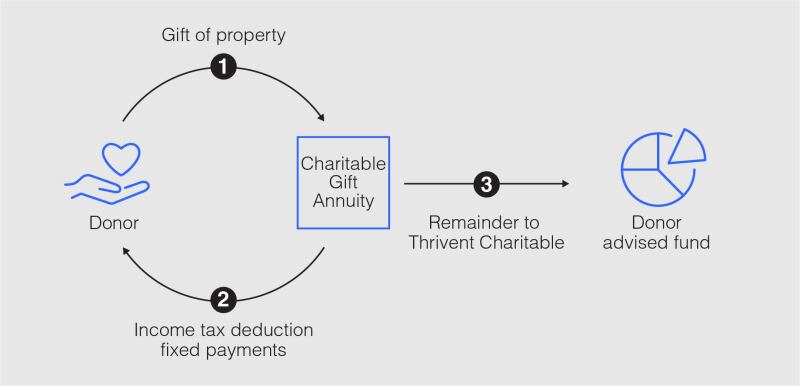

A charitable gift annuity is a gift vehicle that falls in the category of planned giving. For example assume that there is no gift reported on the gift tax only a large note sale which is reported as a non-gift item or a grantor retained annuity trust GRAT that has a nominal almost zeroed-out value. Some important terminology in charitable trusts is the term corpus Latin for body which refers to the.

The donor receives a charitable deduction for the value of the interest received by the charity. To claim a deduction you must be the person that gives the gift or donation and it must meet the following 4 conditions. It must be made to a DGR.

When an annuity is gifted to another party the transaction triggers a taxable event for the donor. To determine the deferred gift annuity rate this factor is multiplied by the immediate gift annuity rate now in effect for the nearest age of the annuitant at the. Charitable Lead Annuity Trust.

For example a taxpayer sells their property to a charitable organization for 100000 but at the time of the transaction the fair market value of the property in question is 200000 and. Deduction for an amount already included in income RRSP or RRIF deduction for a refund of. When the donor dies the charity keeps the gift.

If your donated securities are used to fund a charitable trust or gift annuity there may be estate and gift tax advantages as well. The Board of Directors of the ACGA met on May 17 2022 and voted to increase the rate of return assumption we use when suggesting maximum payout rates for charitable gift annuities. Some commentators have raised the concern that the failure to report charitable gifts may extend the statute of limitations.

Charitable Remainer Annuity Trust. 514 c5A using the 30 Charitable Federal Midterm Rate CFMR for May 2022. For sample forms of trusts that meet the requirements of an inter vivos grantor or nongrantor charitable lead annuity trust see Rev.

Any relevant capital gains will be taxed at the current owners tax bracket. 2055 for an estate tax charitable deduction are quite different from the income tax deduction rules under Sec. A QPRT is a grantor trust with special valuation rules for estate and gift tax purposes governed under IRC 2702.

The IRS will calculate your gifts value and your available deduction at 30000. Charitable gift annuity 06112018. And should the gift occur prior to the annuity owners age of 59 ½ the transaction will be subject to a 10 IRS early withdrawal penalty.

With a charitable gift annuity you have the potential to take a partial income tax deduction when you fund the annuity. If the property was transferred to a charitable remainder trust and the donor andor the donors spouse who is a US. The charitable deduction components in Sec.

Simply input the amount of your possible gift the basis of the property and the ages of the planned income recipients. It also generates good will. See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed.

Announcements Rates Announcement - 6222. Provides income tax deductions. The value of the non-charitable beneficiarys remainder interest is a taxable gift by the grantor.

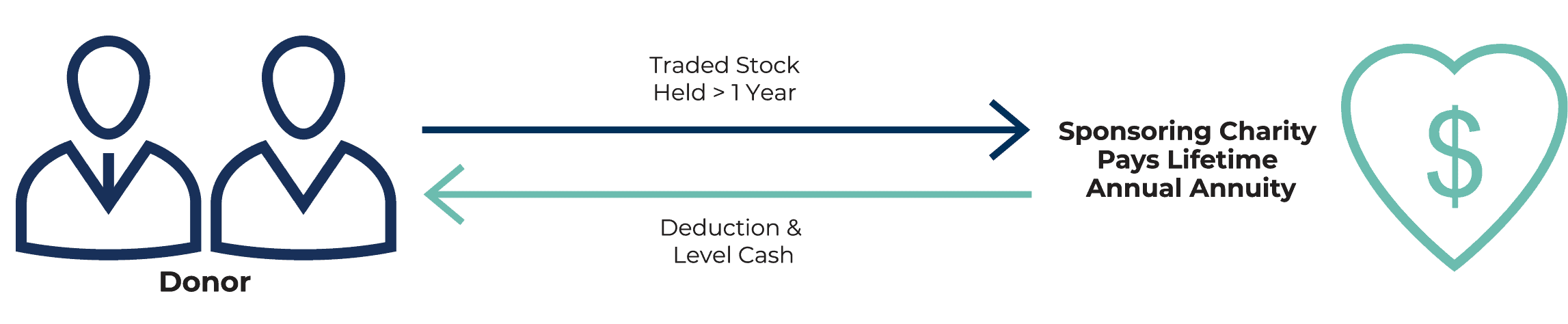

To include gifts of qualified terminable interest property as gifts to his or her spouse for which a marital deduction. Enjoy an immediate partial tax deduction and set aside dollars for your charitable legacy while receiving a continued stream of investment income. It involves a contract between a donor and a charity whereby the donor transfers cash or property to the charity in exchange for a partial tax deduction and a lifetime stream of annual income from the charity.

The deduction amount is based on several variables including the charitable gift annuity yield which is determined by the charity and the beneficiaries life expectancies. A type of gift transaction in which a donor contributes assets to a charitable trust which pays an annuity designed to leave a substantial proportion of the. Check the box if the decedent elected for federal gift tax purposes.

An RRSP a RRIF a PRPPVRSP or an annuity. A charitable trust is an irrevocable trust established for charitable purposes and in some jurisdictions a more specific term than charitable organizationA charitable trust enjoys a varying degree of tax benefits in most countries. Here are some general donation values that may help.

The donor pays the gift tax not the recipient of the gift. The suggested rates comply with the 10 minimum charitable deduction required under IRC Sec. With a charitable remainder annuity trust you receive a fixed dollar amount an annuity from the trust each year.

The benefit to this method is that even if the trusts income is less than anticipated you receive the same amount. Our Charitable Gift Annuity is one of the easiest ways to establish a plan for giving and provide a lifetime of reliable annuity payments. You can claim a tax credit based on the eligible amount of your gift to a CRA qualified donee.

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Charitable Gift Annuities Suny Potsdam

Charitable Gift Annuity Tax Deductions Cga Rates Ren

Charitable Gift Annuities The Field Museum

City Of Hope Planned Giving Annuity

Charitable Gift Annuity Saint Paul Minnesota Foundation

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Studentreach

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities Hampshire College

What Is A Charitable Gift Annuity Thrivent

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuities Giving To Stanford

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Charitable Gift Annuity Eternal Food Foundation

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County